Would You Buy 1% of the Mona Lisa?

Think about having a piece of valuable artwork without needing to pay millions. This is what Fractional NFT Marketplace Development offers. It transforms digital ownership, allowing investors to buy, and sell. And it will enable you to earn from expensive assets in smaller, more affordable portions.

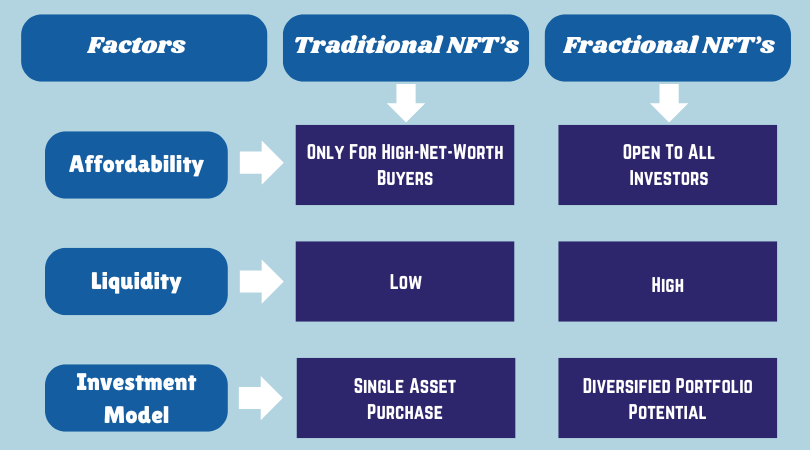

With high-value NFTs locking up capital, fractionalization makes digital assets more accessible, allowing multiple owners to share ownership. This solves the market’s biggest issue lack of liquidity, by enabling easier buying, selling, and trading. This makes the Investors and startups from Thailand to Canada, the US to Japan. All over Europe view fractional NFTs as the future of digital ownership.

Establishing a Marketplace That Appeals to Top Investors

- Democratizing Digital Ownership: More buyers, more demand, higher NFT valuations.

- New Investment Models: Staking, lending, and DAO governance in fractionalized assets.

- Regulatory Challenges: Navigating compliance in different global markets.

How can you create a Fractional NFT Marketplace solution? That draws in serious investors.

Let’s explore.

Why Fractional NFT Marketplace Development is a Game Changer for 2025

Would You Buy a Whole Bitcoin Today?

Many people wouldn’t buy the whole thing. That’s why people can divide Bitcoin into satoshis. The same idea works for NFTs now. Fractional NFT Marketplace Development is transforming how we perceive ownership. Letting investors buy a part of valuable NFTs instead of the entire asset.

Liquidity: The Missing Piece in the NFT Market

- Selling high-value NFTs can be tough, but fractionalization makes it easier.

- Investors can buy and sell smaller parts like stocks, which increases trading.

- Marketplaces gain from more transactions and improved pricing.

Making NFTs More Accessible for Everyone

- Retail investors can buy shares of popular NFTs like CryptoPunks or BAYC.

- Creators earn ongoing income by breaking their work into smaller parts.

- This process makes it easier for more people to invest in NFTs around the world.

VCs and Hedge Funds Are Entering the Game

- Institutional investors view fractional NFTs as a link connecting art. Real estate, and cryptocurrency.

- This fractionalization allows for NFT-backed loans. Integration with DeFi, and opportunities for passive income.

- Improvements in compliance and security are preparing NFT markets for institutional involvement.

How Fractional Ownership Reshapes the Fractional NFT Marketplace Development

Fractional NFT marketplace Clone Script: Why High-Value Investors are Flocking to Fractional NFTs

Traditional investors prefer assets that provide liquidity, reduce risk, and have long-term value. This is what Fractional NFT Marketplace Development services will offer in 2025.

Rather than investing millions in one NFT. Wealthy investors and institutions can spread their investments across various fractionalized assets. Like how they do in the stock market.

The Data Reveals: Fractional NFTs Are on the Rise

- Experts predict the worldwide market for fractional NFTs will reach billions by 2025.

- Popular NFT collections such as CryptoPunks and BAYC are experiencing a rise. in fractional trading activity.

Major investors look for liquidity, security, and a mix of investments. With fractional ownership, they can lower their risk. By diversifying their investments, they reduce risk.

Instead of relying on a single digital asset. They spread their money across sources.

Additionally, it creates opportunities for earning passive income through staking. And NFT-based lending in DeFi.

The Psychology of High-Value Investors

Wealthy individuals and institutions look for scarcity, exclusivity, and controlled risks. Fractionalization provides them access to valuable NFTs while minimizing their exposure. This method fits their interest in regulated, and asset-backed investments. It makes fractional NFT marketplaces attractive.

In 2025, NFT investing will appeal to more than crypto enthusiasts.

Smart investors are entering the space. Will your fractional NFT marketplace development services be ready for them?

Building a Fractional NFT Marketplace Development Company that Investors Can’t Ignore

Fractional NFT Marketplace Development goes beyond dividing NFTs. It focuses on building trust, Providing liquidity, and creating a strong business model. That draws institutional investors.

Regulatory Compliance & Smart Contracts: The Backbone of Investor Trust

- Investors avoid marketplaces that lack clear rules. It’s essential to follow KYC (Know-your-customer) and AML (Anti-Money Laundering) guidelines.

- Smart contracts provide clear asset distribution. And reduce the risk of price manipulation and fraud.

- Platforms that use SEC-compliant security tokens are building trust with investors.

High-Value NFT Listings: What Draws Serious Investors?

- High-value NFTs such as CryptoPunks, and BAYC. And valuable art pieces draw in big investors.

- Tokenized real-world items like Real estate. And rare collectibles are becoming more popular.

- Unique NFTs that generate income, like music rights. And virtual land offers lasting value.

User Experience & Security: Why It Matters

- Institutional Investors seek strong security with blockchain verification.

- A smooth user experience and easy access to fiat currency. And secure storage options encourage people to join.

- Using multi-signature wallets and recovery for private keys increases trust among investors.

Revenue Streams: Making Fractionalized NFTs profitable

- Marketplace fees provide steady revenue.

- Subscription plans for special investor benefits enhance value.

- DeFi features like staking. and yield farming make fractional NFTs sources of passive income.

Fractional NFT Marketplace Development Solutions: Market Trends & Innovations

In 2025, they are changing the way Fractional NFT Marketplace Development services work. As NFTs expand beyond digital art. New technology is transforming how people divide, buy, and manage assets.

Investors want automation. The ability to use different blockchains and tokenization of real-world assets. And the market is responding.

AI & Automation: Smarter Investing with Predictive Analytics

AI tools look at market trends, past data, and how investors feel to help make decisions. Automated pricing for NFTs helps stop market manipulation and keeps prices stable. Smart contracts allow for quick fractional trades, which boosts liquidity.

Cross-Chain & Multi-Chain Integration: Breaking Blockchain Barriers

Investors seek easy asset transfers between Ethereum, Solana, Polygon, and other platforms. Supporting many chains increases liquidity, drawing in investors from around the world. Interoperability allows fractional assets to move. Instead of being stuck in separate systems.

Tokenization of Physical Assets: The Bridge Between Digital and Real-World Value

Sellers are dividing real estate, fine art, and luxury items into shares and selling them as NFTs.

This allows investors to own parts of valuable assets. without needing to buy them outright. Smart contracts provide safe and clear ownership rights.

Community Governance & DAOs: The Future of Marketplace Control

Decentralized Autonomous Organizations (DAOs) allow investors to vote. On important decisions in the marketplace. This community-based governance builds trust, transparency, and lasting involvement. DAOs also transform NFT ownership by changing how people manage assets together.

These market trends and innovations lead many players to be on the track of the fractional NFT marketplace development process. Also, they bring many innovations to NFT marketplace via their startups.

Case Studies: Success Stories in Fractional NFT Marketplace Development

From Startups to Millions… How Fractional NFTs are changing the Game !!!

#1 Rario (India): Tokenizing Sports Memorabilia

- Cricket fans can now own parts of digital collectibles from famous matches.

- Partnerships with leagues have attracted millions of active users.

- Smart contracts provide clear ownership and royalties for creators.

#2 Sygnum Bank (Switzerland): Merging NFTS with Institutional Finance

- The first bank to follow regulations and provide fractional blue-chip NFT investments.

- Wealthy individuals can invest in crypto-art. without taking on the full risks of ownership.

- Their focus on compliance has paved the way for institutions to adopt NFTs.

#3 RealT (USA): Turning Real estate into Tradable NFTs

- Investors can buy small portions of rental properties through blockchain technology.

- These properties generate passive income and distribute it in cryptocurrency.

- This approach combines the liquidity of NFTs. with the reliability of traditional real estate.

Key Takeaways: What Made These Fractional NFT Marketplace Development Work?

- Niche Specialization: Targeting passionate communities (sports, finance, real estate).

- Regulatory Foresight: Ensuring compliance to attract institutional investors.

- Scalable Tech: Using cross-chain integrations and automated smart contracts for seamless trading.

The key takeaway? Developing a fractional NFT marketplace goes beyond. selling parts of NFTs isn’t enough. It focuses on building lasting, valuable ecosystems.

Future of Fractional NFTs and How to Get Started

People are transforming how they invest in assets. as stocks allowed ownership of company shares. Fractional NFT Marketplace Development is simplifying the ownership of assets. This change is increasing liquidity. Draws in institutional investors, and making NFTs more accessible globally.

To enter this growing market, you need a reliable development partner.

Trioangle is a leading fractional NFT marketplace development company. It delivers the expertise to build a secure, scalable, and investor-focused platform.

Will you drive the change or get left behind?

Established NFT marketplaces are changing. The ones that include liquidity solutions, and automated smart contracts. And provide high-value assets that will succeed in 2025. If you’re an entrepreneur aiming to launch a modern NFT marketplace, it’s time to take action.

Launch Your Investor-Ready Fractional NFT Marketplace Today

Collaborate with Trioangle to design a secure, comprehensive, and scalable fractional NFT marketplace. That stands out in this booming market. The future is fractional. Will your marketplace be a part of it?